FTMO Trader Funding Review 2024

Some of the links on this page may link to our affiliates. Learn more about our affiliate policies.

Last Updated: January 5, 2023

FTMO Review

Cost:

€155 - €1,080

Instruments:

Forex, Commodities, Indices, Crypto, Stocks, Bonds

Multiple Accounts:

No limit on accounts, up to $400k per trader or strategy

Leverage:

1:100

Days to Funding:

20

Trading Platforms:

MetaTrader4, MetaTrader5, cTrader

Trading Apps:

Account MetriX, Account Analysis, Statistical App, Trading Journal, Mentor App, Equity Simulator

Highlights:

Free trial, swing account, scaling plan, custom apps, trading academy, performance coach

What is FTMO

In 2014, a few young day traders from Prague joined forces to create FTMO.com. Initially called Ziskejucet.cz. Each had its trading system and had different ideas about risk management and money.

They all have different trading approaches, but they share the understanding that professionalism is only possible through strict discipline and following your own rules. One can achieve professionalism by observing one's rules and allowing others to supervise one. This is the foundation of successful and conscientious trading.

Many traders felt the need for more capital, better discipline, feedback, and more capital. That is why we started this project. It was not an easy journey. There were many disappointments along the way. We now want to help traders who were initially confused become more confident and financially successful. The best thing about our project is that if we make our trader profitable, we are also profitable. Therefore, helping others is in everyone's best interest. We can raise more funds as the project grows. In May 2017, the launch of the FTMO.com international version was prepared.

FTMO is one the fastest-growing proprietary trading firms with funded trade accounts. Funded traders can earn up to 90% of profits. Forex, stocks, commodities, indices, and cryptos are all tradeable assets.

This FTMO review will guide you through the FTMO Challenge account, including signup, member dashboard, and trading platforms. We also examine the pricing, trading objectives details, and evaluation.

Today, FTMO is home to over 180 registered traders. Each month, more than 6 million trades are opened. In addition, $23 million has been paid out in 2021. The average payout processing time is 8 hours.

Forbes has featured FTMO, and they have won the Deloitte Technology Fast50 award three years running. The FTMO Challenge is part of their evaluation and verification. Traders who pass the evaluation process are offered a place in the FTMO Proprietary Trading Firm, where they can manage an account balance up to $400,000.

The offer includes a comprehensive trading journal that allows for account analysis and excellent educational resources.

FTMO Challenge Account Review

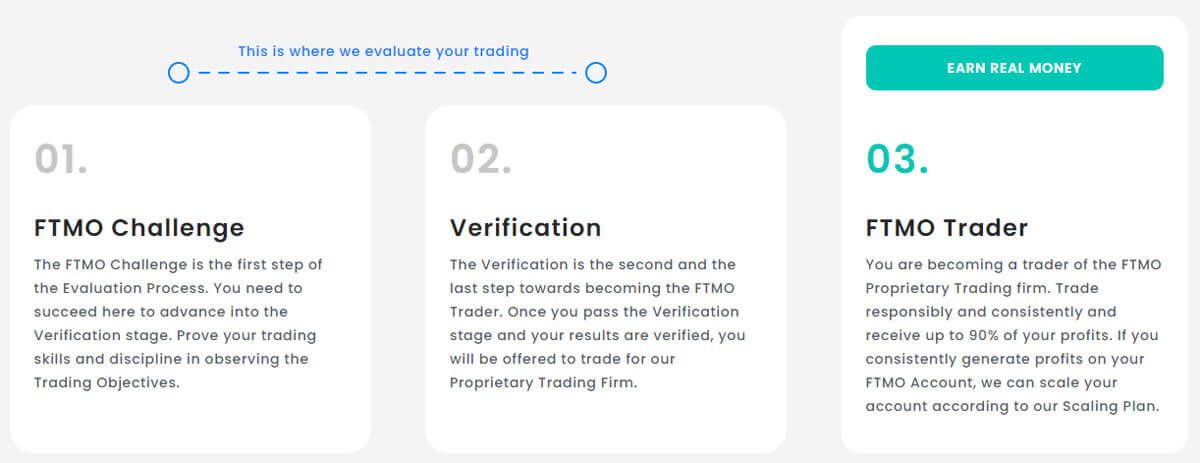

The first step in our E Valuation Process is the FTMO Challenge. Before you are allowed to trade the FTMO Account linked to their Proprietary Trading Firm, they must ensure that you can trade responsibly while managing risk appropriately.

Reasonable rules govern the FTMO Challenge stage. It allows you to trade with a drawdown equal to the profit target. These rules are called Trading Objectives. You don't have to use the full duration of 30 days. Once all Trading Objectives have been met, you will be able to move on to the verification phase. You have to complete the FTMO challenge in a minimum of 10 trading days.

FTMO Evaluation Process

There are two steps to the FTMO evaluation process. The first is the so-called FTMO Challenge. The challenge will require you to demonstrate your trading discipline, skills, and profitability by keeping track of the trading objectives.

Next, we will review the details of the FTMO Challenge and Verification. We also discuss specific trading objectives. There are two possible risk levels: Normal and Aggressive accounts. The Balance to start with can be chosen from the following: $10K, $25K, $50K, $100K, $200K.

$200K starting balance is not available if choosing aggressive route.

FTMO Challenge: Step 1

| Risk: Normal | $10,000 | $25,000 | $50,000 | $100,000 | $200,000 |

|---|---|---|---|---|---|

| Trading Period | 30 Days | 30 Days | 30 Days | 30 Days | 30 Days |

| Minimum Trading Days | 10 Days | 10 Days | 10 Days | 10 Days | 10 Days |

| Maximum Daily Loss (Normal/Aggressive) | $500 / $1,000 | $1,250 / $2,500 | $2,500 / $5,000 | $5,000 / $10,000 | $10,000 |

| Maximum Loss (Normal/Aggressive) | $1,000 / $2,000 | $2,500 / $5,000 | $5,000 / $10,000 | $10,000 / $20,000 | $20,000 |

| Profit Target (Normal/Aggressive) | $1,000 / $2,000 | $2,500 / $5,000 | $5,000 / $10,000 | $10,000 / $20,000 | $20,000 |

| Refundable Fee (Normal/Aggressive) | €155 / €250 | €250 / €345 | €345 / €540 | €540 / €1,080 | €1,080 |

All accounts have a 30-day FTMO Challenge. This means that 30 days is the maximum time you have to achieve the goals. You will be able to move directly to the verification step if you achieve the profit target quicker and comply with all rules. The minimum trading day is ten days. If you do not archive your target within five trading days, you can place trades for five days. To comply with the rules, you can still make small-risk trades if the profit target is not archived within five trading days.

Only one payment is required to begin the challenge. Prices vary depending on how much you have invested in trading accounts. The Verification (step 2) or FTMO Trader (step 3) are free.

Another important aspect of the FTMO Challenge Fee is that FTMO pays the fee back with your first profit split after becoming a fund trader.

Step 2: Verification

| Risk: Normal | $10,000 | $25,000 | $50,000 | $100,000 | $200,000 |

|---|---|---|---|---|---|

| Trading Period | 60 Days | 60 Days | 60 Days | 60 Days | 60 Days |

| Minimum Trading Days | 10 Days | 10 Days | 10 Days | 10 Days | 10 Days |

| Maximum Daily Loss (Normal/Aggressive) | $500 / $1,000 | $1,250 / $2,500 | $2,500 / $5,000 | $5,000 / $10,000 | $10,000 |

| Maximum Loss (Normal/Aggressive) | $1,000 / $2,000 | $2,500 / $5,000 | $5,000 / $10,000 | $10,000 / $20,000 | $20,000 |

| Profit Target (Normal/Aggressive) | $500 / $1,000 | $1,250 / $2,500 | $2,500 / $5,000 | $5,000 / $10,000 | $10,000 |

| Refundable Fee | Free | Free | Free | Free | Free |

The FTMO verification is the second step in your journey to becoming a funded trader at FTMO. However, the time you have to meet the profit target is doubled. This means you have 60 days to complete the Verification process.

Once you have completed the FTMO Challenge, there is no additional fee for the Verification process. Minimum trading days are ten days, which is the same as the requirements for the FTMO Challenge.

You must trade at least ten days per 60 days and keep the profit target goal. After passing the verification step, you will be offered to join FTMO as a funded trader.

Step 3: FTMO Trader

| Risk: Normal | $10,000 | $25,000 | $50,000 | $100,000 | $200,000 |

|---|---|---|---|---|---|

| Trading Period | Indefinite | Indefinite | Indefinite | Indefinite | Indefinite |

| Minimum Trading Days | X | X | X | X | X |

| Maximum Daily Loss (Normal/Aggressive) | $500 / $1,000 | $1,250 / $2,500 | $2,500 / $5,000 | $5,000 / $10,000 | $10,000 |

| Maximum Loss (Normal/Aggressive) | $1,000 / $2,000 | $2,500 / $5,000 | $5,000 / $10,000 | $10,000 / $20,000 | $20,000 |

| Profit Target | X | X | X | X | X |

| Refundable Fee | Refund | Refund | Refund | Refund | Refund |

You have demonstrated that you are worthy of being funded by a prop trading company during the FTMO Challenge. This goal is archived with good risk management, exceptional trading skills, and discipline in Steps 1 and 2.

Step 3 is about archiving your goals to become a funded trader. Your FTMO account will be connected to the company's account. The default profit split ratio for all FTMO traders has been 80/20. This means that you can withdraw 80% of the profits to your bank account.

However, FTMO has a scaling plan, and you may be able to archive a payout ratio up to 90/10, which is a rare industry.

Free Repetition of FTMO Challange

A trader who completes the FTMO Verification or Challenge without reaching the Profit Target, but maintains a loss limit of not exceeding the Max Daily Loss or Max Loss, and closes all positions with any profit (even $0.01), will always be eligible for a free FTMO Challenge. This is an important benefit that should not be taken for granted in this industry.

FTMO Partners with Autochartist

Forex traders most commonly use technical analysis to decide when to close and open their positions. However, technical analysis is not something that everyone can do. Therefore, Autochartist has partnered with FTMO to provide traders exclusive access to Autochartist's analytical services to recognize trading formations.

Autochartist, a well-known tool for traders, allows them to identify trading opportunities and analyze volatility in real-time. In addition, FTMO clients have access to proven statistics that will help them get better results and understand the workings of technical analysis.

The Autochartist service is available to all FTMO clients who currently have an active trading account (FTMO Challenge/Verification/FTMO Account). This service can be used in the Client Area or directly in your MetaTrader or cTrader trading platforms.

The main window of the FTMO Client Section can be divided into three tabs: Volatility Analysis and Trading Opportunities. Performance Statistics are also available. Next, traders can use the MetaTrader or cTrader buttons to access tutorials, files, and other information. The tabs that are the first and second, i.e., These tabs, Volatility Analysis, and Trade Opportunities, will be the most used.

FTMO Trading Objectives

Trading objectives for the FTMO challenge depend on the currency chosen, the risk level, and the account balance.

It would help if you first decided what level of risk you wish to take.

Your maximum daily loss if you choose the Normal risk level is 5% of your initial account balance. The maximum loss and overall profit target is 10% of your initial account balance.

If you choose the risk level Aggressive, all values will double. This means you can lose 10% per day, and your overall profit target is 20%. There is more downside potential with the higher risk level, and you must achieve a higher profit target.

There are five currencies available: USD, GBP and EUR. CZK, CAD, and AUD. For both risk levels, the account balances are $10,000 to $25,000, $50,000, $50,000 and $100,000, respectively. The normal risk level comes with a $200,000 balance.

To summarise, the trading objectives are the maximum daily loss, maximum overall losses, profit target, and challenge fee.

Tradable Assets

FTMO specializes in forex trading. A $10,000 account can be traded with $1,000,000. All major currencies, such as USD/JPY and EUR/USD, are available for trading. There are also less-popular currencies like USD/HKD and EUR/NOK. For a total of 44 currencies that can be traded via FTMO.

Trades can be made with eight metals, 14 cash indexes, four futures, and ten futures contracts. There are also 23 equities that traders can trade via contracts for difference.

Proprietary Trading Company FTMO

FTMO grants traders who pass the evaluation a funded account. FTMO Trader US s.r.o. signs the contract for global traders from the United States. FTMO Trading Global s.r.o. also signs the contract for traders outside the United States.

This is a simple solution because traders work directly with the same brand starting at the FTMO Challenge through the Verification process and ending up in the trading account.

FTMO Prices

To become a funded trader at FTMO, you will need to pay a fee. However, you can return the fee paid if you become a funded trader with FTMO.

You can try again if you don't complete the 3-step process.

Two factors affect the fee structure: first, the chosen level of risk, and second, the trading account balance.

Pay in the currency of your locality. For example, if you're in the United States, you will pay in USD. If you're from the EU, your payment is in Euros, etc.

Risk Level: Normal

- 10,000 accounts: 139.50 Fee

- 225.00 Fee for 25,000 accounts

- Accounts up to 50,000: 310.50 Fee

- 100,000 accounts: 486.00 Fee

- Account: 200,000, 972.00 Fee

Risk Level: Aggressive

- 10,000 accounts: 225.00 Fee

- Accounts up to 25,000: 310.50 Fee

- Accounts up to 50,000: 486.00 Fee

- 100,000 accounts: 972.00 Fee

The Aggressive risk level doesn't have 200,000 accounts, and the cost is similar to the next higher level of the normal risk level. For example, 225.00 is charged for the 25,000 accounts at the normal risk level. However, the aggressive risk level allows you to get the 10,000 account challenge at 225.00.

FTMO Platform Information

After you sign up for FTMO, either by starting your favorite trading challenge or signing up for the free trial demo accounts, you will be able to log in to the FTMO Dashboard. You can also access your FTMO account, risk management tools, and the trading academy from this dashboard.

Click on Client Area and Credentials in your FTMO Challenge section to open your trading account platform. A popup will open, allowing you to see the login credentials and the link to your trading platform.

In my case, I chose the MetaTrader 4 platform. I can install MT4 on the web or download it from the MetaTrader 4 platform. The login details are required for the first login. Next, select the FTMO Server. Does login fail? Change the FTMO Server in the drop-down menu.

You can now trade based on your preferred trading strategy's technical and fundamental analysis of forex markets. You will be able to complete the Step 1 FTMO Challenge, Step 2 Verification Process, and finally, become an FTMO Trader. This allows you to keep between 80% to 90% of your profits through trading the prop firm trading capital.

FTMO Apps

FTMO Account MetriX

Account MetriX, an innovative web application that tracks your progress toward becoming an FTMO Trader, is unique. Account MetriX is available to all traders taking on the FTMO Challenge, Verification, or Free Trial. This web application gives you a comprehensive overview of all Trading Objectives. You will also find many statistics in the Account MetriX that every trader should know.

Each trade will be recorded in the FTMO Metrix Section. Go to your FTMO dashboard and select Metrix to access the tracking dashboard. You will see the current status, your challenge starts and finish dates, account size, provider, chosen platform, and all of your results.

You can also view the Trading Objectives status for your challenge, including the four rules.

- Minimum 10 Trading Days

- Maximum Daily Loss

- Maximum Total Loss

- Profit Target

After completing all objectives, you can move on to the next step. A trading journal is also available in the FTMO Metrix view. Click on the refresh button to view the most recent statistics as an active trader.

FTMO Account Analysis

FTMO knew that they needed to give traders an objective look at their trading results when they created this project. Why? It doesn't matter if the trader is a novice or a pro; a different opinion is always helpful. Trading can be lonely for traders. Sometimes even your closest friends don't understand what you are doing on your computer for long hours.

How does FTMO prepare an Account Analysis? First, they analyze your trading data (including those not usually available) and create a series of indicators to help you optimize your strategy.

FTMO Statistical App

The Statistical Application will give you numbers-based probabilities about market behavior that you can use to your advantage. As a result, trade smarter and increase your profitability immediately.

Suppose the market trades slightly below the High in a previous session, and you know that the market has broken the High in 92% of previous sessions under similar circumstances. In that case, you either won't be trading short, or you'll go long to speculate on what the High will be.

FTMO Trading Journal

Trading results are not something traders enjoy, but keeping them in order is possible with our Trading Journal. You can store all trades in the journal automatically. Also, you can record your feelings and thoughts about each position. As a result, you will find a lot of useful information to help you avoid future trading errors. You can also add comments and attach screenshots to each trade.

The retrospective analysis will allow you to experience every trade multiple times. As a result, you won't make the same mistakes again, and your trading will be much more enjoyable.

FTMO Mentor App

The Mentor Application is an innovative application that assists traders in achieving better results by strengthening their discipline. The Mentor Application requires you to adhere to your own rules and limit risk. It monitors your Trading Objectives and offers many other useful features. It is compatible with the MetaTrader 5 and MetaTrader 4.

Overtrading and greed are unacceptable. Our Mentor Application will help you to strengthen your discipline.

FTMO Equity Simulator

The equity curves don't move in straight lines. Drawdowns are something that every trader has to deal with. Simulating any outcome is a good way to cope with randomness. Your strategy still performs within the expected drawdown range if you know it has drawdowns of around 20%, but you are only in the 11% drawdown.

The Equity Simulator's goal is not to predict how much you will make in the future but to give you a glimpse at all possible outcomes so you can be ready for them.

Trade Platforms Available

FTMO supports three of the most popular trading options:

- MetaTrader 4

- MetaTrader 5

- cTrader

They are all free and come with no markup on demo trading accounts or virtual funds.

Summary of FTMO Review

FTMO is a great proprietary trading platform for forex traders. The FTMO Challenge rules, as well as the Verification process, are clear and well-documented. The pricing is fair, and traders love the support trading tools.

FTMO is looking for trading talent and offers a fund account to successful forex traders. The payouts range from 80%-90% of the profit generated by the trader.

For traders with low capital who wish to trade large accounts but not risk their capital, the FTMO Challenge can be a great option. It takes talent, skill, and discipline to keep the goals organized. However, it can also be extremely beneficial in success because the FTMO Challenge participation fee is refunded with each profit split. This means that trading success leads to a fund account with zero risk capital.

FTMO's main focus is a forex, with 44 currency pairs available for trading. In addition, FTMO is a unique platform that allows you to trade crypto CFDs such as Bitcoin Dash and Etherum. This makes it a great choice.

Join FTMO now with a free trial. Or, choose your favorite trading challenges.

Future traders will prefer TOPSTE to FTMO since only NGAS, the Dollar Index, Euro Bund, and US 10yr T-Note are available for futures trading with FTMO.

Let's conclude the FTMO review with a look at the pros and cons.

Pros

- You can trade capital of prop firms without risking your savings

- Divide profit, so traders get between 80%- 90% of profits

- The fee can be refunded once a trader passes the assessment process and makes money with the fund account.

- There are many fiat currencies and cryptos that can be traded

- Transparency in pricing, rules, and account types

Cons

- Stocks and futures trading is not recommended.

See more of The Best Funded Trader Programs for 2023

FTMO FAQs

Risk Disclosure: This content is provided for informational purposes only. We strive to make the content accurate and current by updating it often. Sometimes, the actual data may differ from what is stated on our website. onlineproptrading.com operates independently. Although we are an independent platform, advertisements and sponsored products may compensate us. We also receive compensation for clicking on links on our website. Authors and contributors are not certified or registered financial advisors. Before making any financial decisions, you should consult a financial professional.